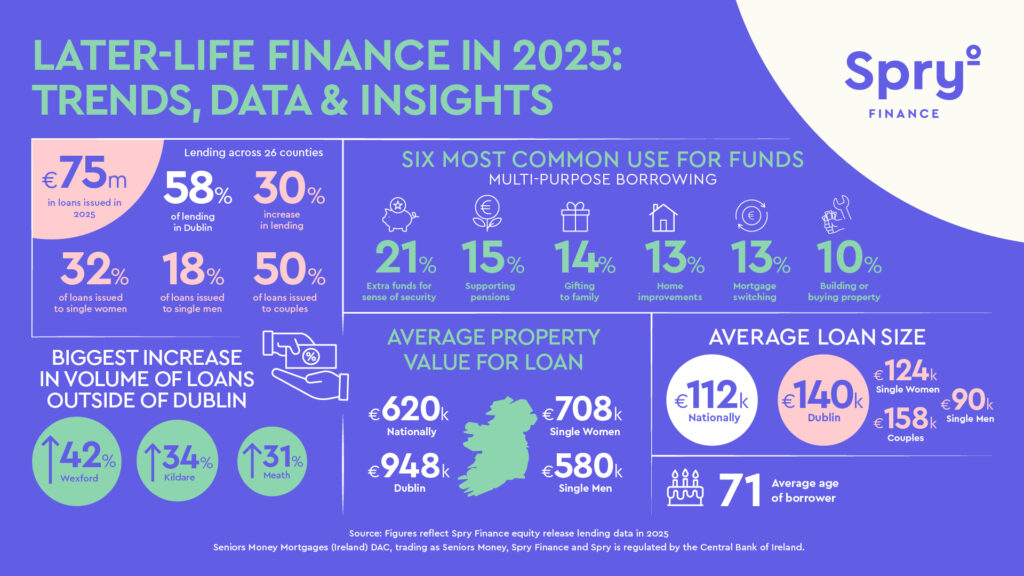

1 in 3 equity release loans going to single women as total lending at Spry Finance rises 30%

- €75m in loans issued in 2025 with an average loan size of €112,000

- Dublin leads the way but lending is across 26 counties

- 40% increase in gifting to family – as more parents provide living inheritance to children

Dublin: Single women accounted for one in three equity release loans issued in Ireland last year, according to new figures from Spry Finance.

Spry reported total lending of €75m in 2025, a 30% increase year-on-year. The figures reflect how equity release loans are increasingly being used to help support retirement, refinance existing mortgages, and help support families with a living inheritance. Since re-launching on the Irish market in 2021, Spry has now lent more than €250m to people aged over 60.

The data shows that 32% of all lending in 2025 went to single female homeowners – including widowed, divorced and separated women – with 50% to couples and 18% to single men. The trend was particularly evident in Dublin, where higher property values and cost-of-living pressures are driving demand for more flexible financial solutions in later life.

Spry Finance Director David Brady said: “What we’re seeing is a shift in how women are using the value tied up in their homes. Issues such as the gender pay gap or career breaks mean that women are more likely than men to have insufficient pension provisions. Increasingly, some are using equity release as a way to create financial breathing space – whether that’s for repaying an existing mortgage, topping up retirement income, or upgrading their home. Lifetime Mortgages mean they don’t have to downsize, they can remain in the home they love while taking greater control of their later life financial needs.”

Nationwide Lending

Dublin accounted for 58% of total lending, with loans issued across almost every Dublin postcode, and particularly strong demand in Dublin 4, 5, 13, 15, 16, and 18.

Strong growth was also recorded outside the capital, with a 42% rise in volume of loans in Wexford, 34% in Kildare, and 31% in Meath. Lending was provided to customers in all 26 counties, demonstrating nationwide demand for lifetime mortgages and lifetime loans.

Refinancing emerged as a significant driver both in Dublin and nationally, increasing 38% year-on-year in terms of value as homeowners used lifetime mortgages to replace traditional mortgages or pay off short-term borrowing. This allows many customers – particularly those on fixed retirement incomes – to reduce monthly outgoings and improve cashflow certainty in later life.

Multi-purpose Borrowing

Data from 2025, shows that around two-thirds of equity release customers use their funds for multiple purposes, underlining how lifetime mortgages are increasingly being used as a flexible financial planning tool for later life. The most common uses of funds by borrowers in 2025 were:

- 21% – Extra funds for sense of security

- 15% – Supporting Pensions

- 14% – Gifting to family (up 40% on 2024)

- 13% – Home improvements

- 13% – Mortgage Switching / Refinancing (up 38% on 2024)

- 10% – Building property or buying property

The majority of those refinancing debt, did so from credit servicers (67% of loan offers), whilst others did so from traditional banks and credit unions. This reflects the number of people carrying mortgages into retirement and those who are seeking alternative and flexible financial solutions.

Customers borrowed slightly more last year, with the average loan size increasing by 14% to €112,000 on 2024, a figure that rises to €140,000 in Dublin. Women borrowed more than men in Dublin – an average of €124,000 versus €90,000, while for couples the figure was €158,000.

The average value of a property on which a lifetime mortgage was secured was €708,000 (median value €620k) for a single woman and €580,000 (median value €535k) for a single man. In Dublin for a couple, the figure rises to €948,000 (median value €682k).

The average age of Spry’s customers in 2025 was 71, with borrowers ranging from 55 to 90 years of age. The company launched a Payment Reward Lifetime Mortgage product last July, which combines key features of an interest only mortgage and a lifetime mortgage and is available to those over 55. All of Spry’s other lifetime mortgages and loan products are available to those over 60.

Mr Brady added: “For most people, equity release is about providing choice – the choice to stay in the home you love, to make improvements that support your later life, to access some of the value built up in your home over a lifetime but to do so on your own terms. Our lending data shows that lifetime mortgages are becoming a more mainstream part of later life financial planning in Ireland, helping people to maintain their lifestyle, support family, and enjoy greater control over their retirement years.”

Click here to read more Later-Life Insights in 2025: Trends, Data & Insights

About Spry Finance

Spry Finance, launched in 2021, is the retail arm of Seniors Money, an Irish-owned lifetime loan provider that has been operating successfully in Ireland since 2006 and has more than €480m of assets under management across its lending and servicing platform, and loan portfolios. The company is regulated by the Central Bank of Ireland and is authorised by the CBI as a Retail Credit Firm. It is fully funded by a number of major international financial institutions including Canada Life Reinsurance. Spry Finance is a customer-focused company, providing older people with real options for living a greater life in later life. Keep up to date with Spry Finance news.